Many NZ businesses get tax refunds from two R&D tax credits or grants at the same time, such as the RDTI and the R&D Loss Tax Credit. Find out which combinations could work for your business, and how much they add up to.

Three Major Funding Streams for R&D

If your New Zealand-based business is investing in Research and Development (R&D), you should be considering all three major NZ government R&D funds:

- Research and Development Tax Incentive (“RDTI”): Up to 15% of R&D spend

- R&D Loss Tax Credit ("RDLTC”): Up to 28% of R&D spend

- New-to-R&D Grant: Up to 40% of R&D spend

Each fund can pay cash reimbursements (sometimes called tax credits) up to a percentage of your expenditure on R&D. Depending on your situation, you can combine these funds to increase the benefit. In good news for early-stage businesses who aren’t paying income taxes just yet – you can still get the cash.

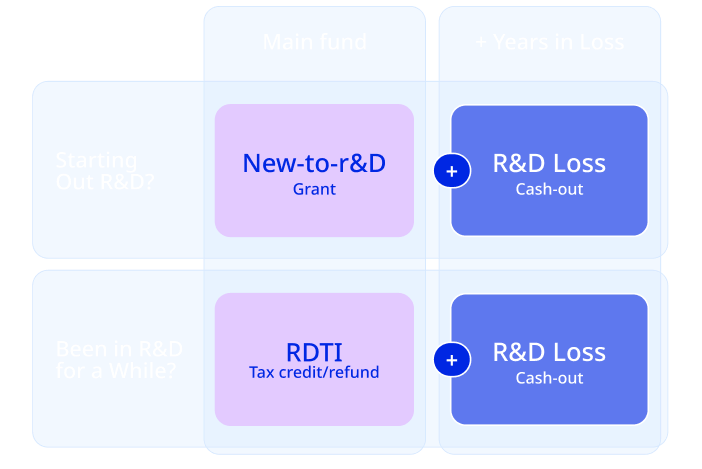

Which Combination of R&D Funds Makes Sense?

Most private sector businesses investing in R&D can get the RDTI , but if you are instead eligible for the New-to-R&D grant , then that is a better option, as it pays a higher percentage, and is always in cash. You can’t hold both at the same time, but you can switch to the RDTI when the grant runs out.

If your business also makes a loss over the tax year, then you may be able to ‘cash-out’ some losses through the R&D Loss Tax Credit program . This effectively swaps tax losses for cash refunds. If done properly, this refund will be in addition to your RDTI or grant benefits.

Best Strategy

Go for the New-to-R&D grant if you can (RDTI if you can’t), then also claim a cash-out every year if you have losses.

Starting Out - If You're Still ‘New’ to R&D

For businesses just starting out with R&D investments, you may be eligible for the New-to-R&D Grant. This is available to existing, more mature businesses as well as to new ventures and startups. The key rules are that you must have spent less than $150,000 on R&D in the last three years, and received less than $5,000 in government support for that.

The grant is open for applications anytime and can give you two year’s of forward approval for regular payments. The amount is 40% of your upcoming R&D spend, to a maximum grant of $400,000 (for $1 M spend).

If your business then makes a loss at the end of the tax year, you can add an R&D Loss application alongside your tax return, to cash-out the portion of losses from R&D that were not funded by the grant.

Scenario 1 – Still ‘new’ to R&D, profitable year:

Your Expenses | New-to-R&D grant | R&D Loss Tax Credit | Total refund | |

Grant-funded | $400 k | $400 k refund | - | $400 k |

Self-funded | $600 k | - | - | - |

Total | $1 M | $400 k (40%) |

Scenario 2 – Still ‘new’ to R&D, loss-making year:

Your Expenses | New-to-R&D grant | R&D Loss Tax Credit | Total refund | |

Grant-funded | $400 k | $400 k refund | - | $400 k |

Self-funded | $600 k | - | $170 k cash-out | $170 k |

Total | $1 M | $570 k (57%) |

For the More Serious R&D Spenders

If you’ve blown past the $150k on R&D, or otherwise don’t qualify for the grant, you may instead be able to claim the RDTI. The initial evaluation of your work is rigorous, but it can give you pre-approval for a list of R&D activities over the next three to five years.

Businesses should look to apply before the end of the first year they have significant R&D expenditure. Once pre-approved, you then submit expenditure claims at the end of each tax year, to receive tax credits or cash refunds (depending on your tax situation) up to 15% of that year’s R&D spend.

And as before, for each year that your R&D put your business into a loss, you can still add an R&D Loss application alongside your tax return, to claim 28% of the R&D expenditure as a cash refund. This applies whether or not that expenditure is eligible for RDTI, giving you up to 43% benefits.

Scenario 3 – Ongoing R&D investor (profitable)

Expenses | RDTI 15% | R&D Loss Tax Credit 28% | Total Benefit | |

RDTI projects | $1 M | $150 k credit/refund | - | $150 k (15%) |

Other R&D | $1 M | - | - | - |

Scenario 4 – Loss-making from heavy R&D investment

Expenses | RDTI 15% | R&D Loss Tax Credit 28% | Total Benefit | |

RDTI projects | $1 M | $150 k credit/refund | $280 k cash-out | $430 k (43%) |

Other R&D | $1 M | - | $280 k cash-out | $280 k (28%) |

When the Cash Hits the Bank

You may have noticed that all three programs pay you refunds or credits after your spending, so you need to have other financing up-front. You can think of them as partial refunds or rebates, to part-finance your projects, boost your cash flow along the way, and extend your total budget or timeline.

When the refund arrives, you are then free to spend that on R&D, and continue to claim the new expenditure.

Not all R&D is Created Equal

Believe it or not, the definition of R&D is different for each fund, so careful attention is needed to determine what activities and expenditure is eligible for each. There are also different caps, exclusions, terms and conditions for each fund, different access processes and deadlines, and all come with certain requirements for reporting, record-keeping and potential repayment.

Remember too that the RDTI and R&D Loss Tax Credit are delivered via the tax system to all who qualify, whereas the New to R&D grant has a limited total pool of funding available, which is subject to availability.

Get Clarity from BlueRock’s NZ-based R&D Consultants

Act now, because deadlines apply. Sadly, we often see businesses that miss the deadlines for R&D funding. Ask your BlueRock advisor about how your situation is suited to each fund. You can get in touch with our R&D grants consultants via the form below and we’ll arrange a free consultation to discuss your business needs.

Further Reading on R&D Funding in New Zealand

BlueRock's regularly updated list of New Zealand R&D grants & tax credits - Investing in R&D? Dont Pay Full Price.

Learn more about the RDTI - Can I Get R&D Tax Credits? Understanding NZs RDTI Definitions.

Learn how to claim R&D Tax Credits - Another Tax Year is Ending. Get Ready to Claim Your R&D Credits.

RDTI information

https://www.ird.govt.nz/research-and-development/tax-incentive

New to R&D Grant

https://www.callaghaninnovation.govt.nz/products/fund/new-to-r-and-d-grant/

https://www.thebluerock.co.nz/services/grants-incentives/new-to-r-d-grant/

R&D Loss Tax Credit

https://www.ird.govt.nz/research-and-development/loss-tax-credit

https://www.thebluerock.co.nz/resources/how-to-secure-r-d-loss-tax-credit/

Disclaimer: This article is intended to be an overview only and is necessarily of a general nature and not comprehensive. There are additional exclusions, limits and conditions to be considered when preparing your application and claim. We highly recommend seeking professional advice in relation to this subject.