Loans to diversify your SMSF

Purchasing property within an SMSF is a great way to diversify your superannuation and expedite its growth. We're experts in SMSF lending and manage the funding process from application to settlement, ensuring the loan complies with the SIS Act, and that you get the most competitive finance available.

Financing Property Via a Limited Recourse Borrowing Arrangement (LRBA)

What is a Limited Recourse Borrowing Arrangement (LRBA)?

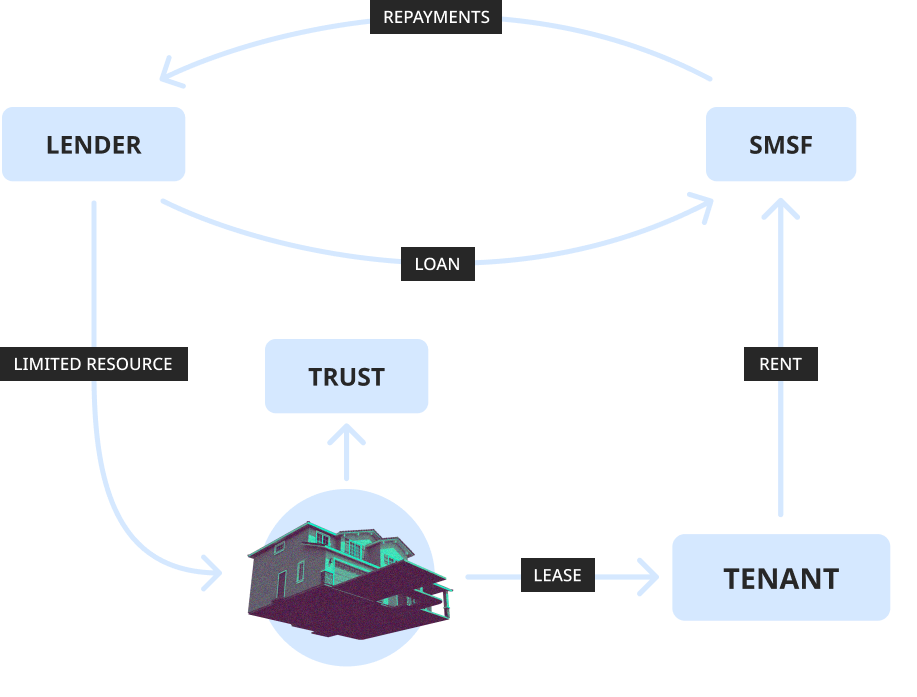

An LRBA is when an SMSF takes out a loan to purchase direct property. An SMSF can borrow from the banks or a lender (unrelated) or from a related party (themselves).

The SMSF uses the borrowed funds to buy a single asset to be held in a separate trust. It’s crucial that before you sign a contract on that perfect property, you speak to a mortgage broker to check if your SMSF will meet the lender's servicing requirements. In some states you also need to have the LRBA structure set up prior to signing the purchase contract.

How Does SMSF Lending via a LRBA Work?

Let’s use a cabinet maker's business as an example. The cabinet maker has $500,000 of net assets in his SMSF. He targets an opportunity to buy his business’s workshop freehold for $1m and puts in an offer ‘subject to finance’. He reaches out to the BlueRock Finance team who complete a serviceability assessment to ensure the income of the SMSF can meet the proposed loan repayments.

In this case, the debt servicing position was sound, and after obtaining a valuation on the property to confirm market value, the lender approves a loan at 80% of the purchase price.

So, where are we at? The total purchase price is $1,000,000 with stamp duty estimated at $55,000. Total cost equals $1,055,000. A loan at 80% of the purchase price is $800,000 making the cabinet maker’s super fund’s contribution $255,000 in cash, plus fees and charges. A new bare trust is then set up to buy the property on behalf of the SMSF, and the lender has no recourse to the SMSF, only to the bare trust and the individual members of the fund.

Investing in Property with your SMSF

Limited Recourse Borrowing Lenders