Personal Insurance

Personal insurance typically refers to 4 types of insurance: Life, Total & Permanent Disability, Trauma and Income Protection. Personal Insurance is designed to provide a payment when you need it most.

What is Personal Insurance?

Personal insurance typically refers to 4 types of insurance: Life, Total & Permanent Disability, Trauma and Income Protection. It does not replace the need for health insurance, rather it complements it. There are certain events in life that we cannot foresee, and health insurance may help with your hospital and/or ancillary benefits, but that’s where it ends.

Personal Insurance is designed to provide a payment when you need it most. This could range from the short-term inability to work due to illness or injury, to more severe illness or prolonged disability and death. The price of your insurance policy will depend on the level of cover in relation to age, gender, occupation (where applicable), lifestyle and health factors.

How does it work?

Life Insurance

Life insurance pays a lump sum payment in the event of the death of the life insured. The owner of the life insurance can be the life insured themself, or someone else such as a spouse or business partner.

Features

In most instances of comprehensive life insurance, they will also pay out in the event of terminal illness.

Exclusions

- In the first 13 months of taking out life insurance, suicide is not covered.

- Acts of war or terrorism.

- Superannuation and Employer group cover, as well as some direct (online) life insurance policies, have specific exclusions. You should be familiar with the terms of your policy and what is covered.

Taxation

If you hold your life insurance personally, there is no tax payable on the benefit at claim and premiums are not tax deductible to you. Should you choose to hold it in superannuation, any benefit payment will be paid to the superannuation fund and form part of its balance. It may then be subject to tax on payment to beneficiaries depending on how and to whom it is paid. Life insurance held for business purposes is treated differently depending on who owns the policy, who pays the premium and the purpose of the insurance.

Total & Permanent Disability (TPD)

TPD is where you receive a lump sum payment in the event of being totally or permanently disabled and unable to ever return to work. It is generally defined as being unable to ever work again in any occupation due to sickness or injury. In the event of claim, the Insurer will assess the daily duties you can and cannot do, and if in conjunction with medical professionals they deem you unable to ever work again, a claim is paid. The less daily duties you can do (showering, eating, walking etc.), the more likelihood of a policy being paid.

TPD is the most uncommon of all personal insurances to be paid as the definition is most difficult to meet.

Features

- TPD with an Any Occupation definition limits your ability to claim by requiring you are unable to work in any occupation that you are suitably qualified by skill or experience to do. In other words, if you cannot do your job anymore you could potentially apply your knowledge and skills to another job.

- TPD with an Own Occupation definition is a little broader in that it is limited to returning to your own occupation.

- TPD with a Home Duties definition provides a level of cover to those working at home who are unable to perform their home duties.

- You can generally link TPD to other lump sum insurance (Life, Trauma) and this reduces the cost of cover. It also means at claim time, the level of cover on the remaining cover types will reduce by the TPD claim amount.

- Buy back is generally an additional option offered by the insurer, where TPD is linked to a life policy. This helps to ‘buy back’ the reduction in life cover after a TPD claim has been paid. Normally after 12 months but can be offered as accelerated.

Exclusions

- Not payable if TPD caused by a self-inflicted act.

- Other specific exclusions may be added to individual policies.

Taxation

TPD is not assessable for tax and premiums are not tax deductible when personally held. The exception to the rule is where TPD is owned for business purposes or when it is held in superannuation. It is common practice to ‘gross up’ TPD insurance when held within super to provide a buffer to pay any tax at claim.

Trauma

Trauma insurance pays out a pre-determined lump sum amount in the event you suffer a specific medical event. These events are specified in the Product Disclosure Statement (PDS) of the Insurer. Examples of such conditions would be heart attack, stroke, cancer, blindness or deafness. There are on average 40 medical conditions / events for which you will be covered.

It will not pay a benefit if you do not survive 14 days following the trauma event. Using the heart attack example, if you die from it immediately, it will not pay. You need to have the heart attack and live for the following two weeks in order to be paid.

Features

- Payment at claim is not related to employment, it is paid on medical diagnosis.

- You can generally link Trauma to other lump sum insurance (Life, TPD) and this reduces the cost of cover. It also means at claim time, the level of cover on the remaining cover types will reduce by the Trauma claim amount.

- Premium or Plus trauma policies cover an extended range of events and / or partial payments on the standard medical events.

- Reinstatement is generally an additional option offered by the insurer, that allows you to reinstate your trauma policy after you have made a claim. Generally, the medical event you claimed will no longer be available under the reinstated policy.

- Buy back is generally an additional option offered by the insurer, where Trauma is linked to a life/TPD policy. This helps to ‘buy back’ the reduction in life cover after a claim has been paid. Normally after 12 months but can be offered as accelerated.

- By the nature of the policy, trauma cannot be held within superannuation.

Exclusions

- New trauma policies will have a 90-day qualifying period on certain medical events such as heart disease, stroke, cancer.

- Other specific exclusions may be added to individual policies.

Taxation

Tax is not payable, nor is it tax deductible.

Income Protection

Income Protection insurance, as its name suggests, is designed to protect part of your income. Unlike Life, TPD & Trauma, it does not pay a lump sum. The Insurer will pay you a monthly income stream to meet your normal living costs.

You can only get Income Protection insurance if you are employed on a part or full-time basis and generally for up to 70% of your annual income. There are measures in place to make sure you cannot get more from income protection than you would earn if you went to work. This is to make sure there is some incentive to return to work.

Features

There are many features to Income Protection insurance. We have listed the key features here:

- Waiting period – or how long you are not working due to sickness or injury, before the insurer will start to pay the monthly benefit. Some policies will allow you working on reduced hours during this period.

- Benefit period – or how long you would like the monthly benefit to be paid for when on claim; 1, 2 or 5 years, or to age 65. Generally, the longer the benefit period, the more costly the policy will be.

- Indemnity contract – where proof of your income is required at claim time rather than at time of application. This carries some risk as your income may have reduced or become more volatile which impacts the benefit paid. Some policies now average the last three years of income pre-claim to reduce the risk of recent changes to your income.

- Agreed value contract – where proof of your income is required only at the time of application. On claim the insurer will pay you the agreed level of cover and does not take your income at claim time into account.

- Full or partial benefit – where, upon total disability or inability to work, you get access to the full benefit however you may be entitled to a partial benefit for a reduced working capacity in some scenarios.

- Super contributions - these can be covered as an optional add on to the policy so that you can continue to build your retirement savings while you are not working.

- Lump sum TPD option - this gives you the choice at claim to take the benefit as a lump sum rather than monthly income stream. It must be nominated at policy commencement as it will reduce the deductibility of your premiums for the life of the policy.

Exclusions (examples)

- Redundancy or unemployment. IP is designed to cover illness or injury, not changes to employment.

- Intentional self-inflicted act.

- War.

- Normal pregnancy.

- Elective surgery or treatment (normally in the first six months of the policy).

- Specific exclusions as detailed in your policy.

Offsets

There are some payments you receive which may reduce the benefit amount you get whilst on claim for your Income Protection insurance. These vary by insurer but generally include:

- Workers compensation.

- Motor vehicle accident claim.

- Other disability insurance.

- Social security benefits.

Taxation

Premiums are generally tax deductible if held personally whilst benefit payments at claim time are treated as assessable income and must be declared in your tax return for tax to be paid.

Premium Structure

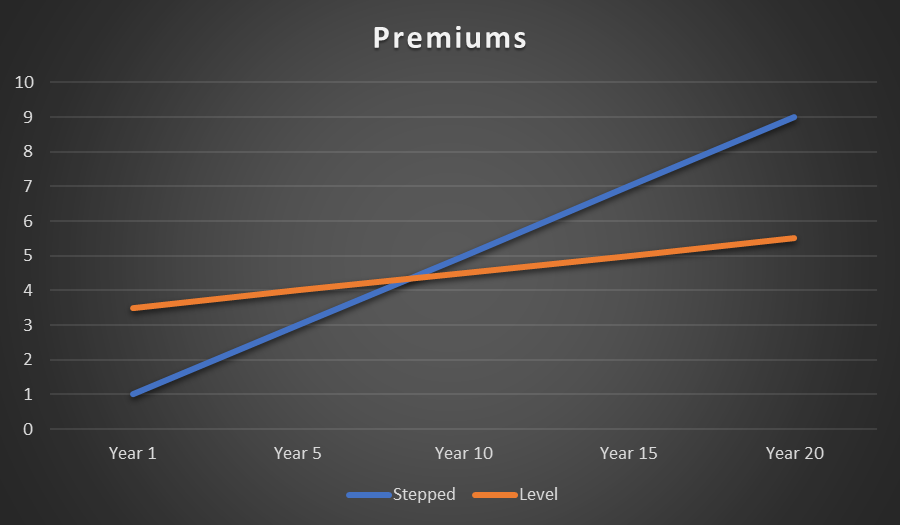

There are two types of premiums; variable age-stepped / variable , or some combination of both. Variable age-stepped premiums (previously known as stepped) do exactly that. Step up, or increase, with each year of age. They tend to be the low-cost option on commencement of the policy but get more expensive over the life of the policy. Variable premiums (previously known as level) start off higher than stepped and finish lower. Often level premiums are adjusted for CPI so you should expect some movement in the premiums over the term of the policy.

Insurance held through superannuation

You can hold Life, TPD and Income Protection insurance through super. There are pros and cons to this strategy.

What are the benefits?

- Premiums can be paid from the balance of your super fund.

- Concessional contributions can be used to pay your premiums. If you pay less tax on these (15% compared to your marginal tax rate and an additional 15% if income is above $250,000), the insurance effectively costs less.

- Your super fund trustee may pass on the 15% tax deduction they get for your premium payment, effectively reducing the cost of your insurance by 15%.

- Some super policies are group policies and cheaper due to the nature of the cover and ‘group’ (bulk) insurer premium rates.

- Your policies are less likely to lapse due to non-payment as your super balance is replenished with employer contributions at a faster rate than premiums are deducted.

What should I be thinking about?

- If you choose to pay premiums from your super balance, you may have less money for retirement.

- Claim approval will need to be done twice before being paid, once by the insurer and once by the trustees of the super fund.

- Not all features and benefits are available with super owned policies.

- Group cover can be simplified cover with lower quality cover and more exclusions.

- Some cover is linked to employment and if employer contributions stop, so too does the cover.

- Tax may be payable on insurance payments as they are treated as lump sum death benefit payments. You should discuss these implications with your adviser so that you understand the tax impacts of super ownership.

Important information regarding this information

This information is of a general nature. It does not consider your personal objectives, needs or situation. It does not represent legal, tax or personal advice and should not be taken as such. If it has been provided to you with a Statement of Advice (SoA), you should rely on the personal advice in the SoA.

Care has been taken to provide up to date and accurate information relating to the subject area however BR Advice Pty Ltd (ABN 30 612 056 523, AFSL 488655), Blue Rock Private Wealth Pty Ltd (ABN 95 166 927 055, AFSL 452733), and their representatives make no representation as to its accuracy or completeness.

Published: January 2025.

© Copyright 2025.