Investments

There are several steps to follow to build a portfolio that suits your financial goals and preferences.

Building a Portfolio

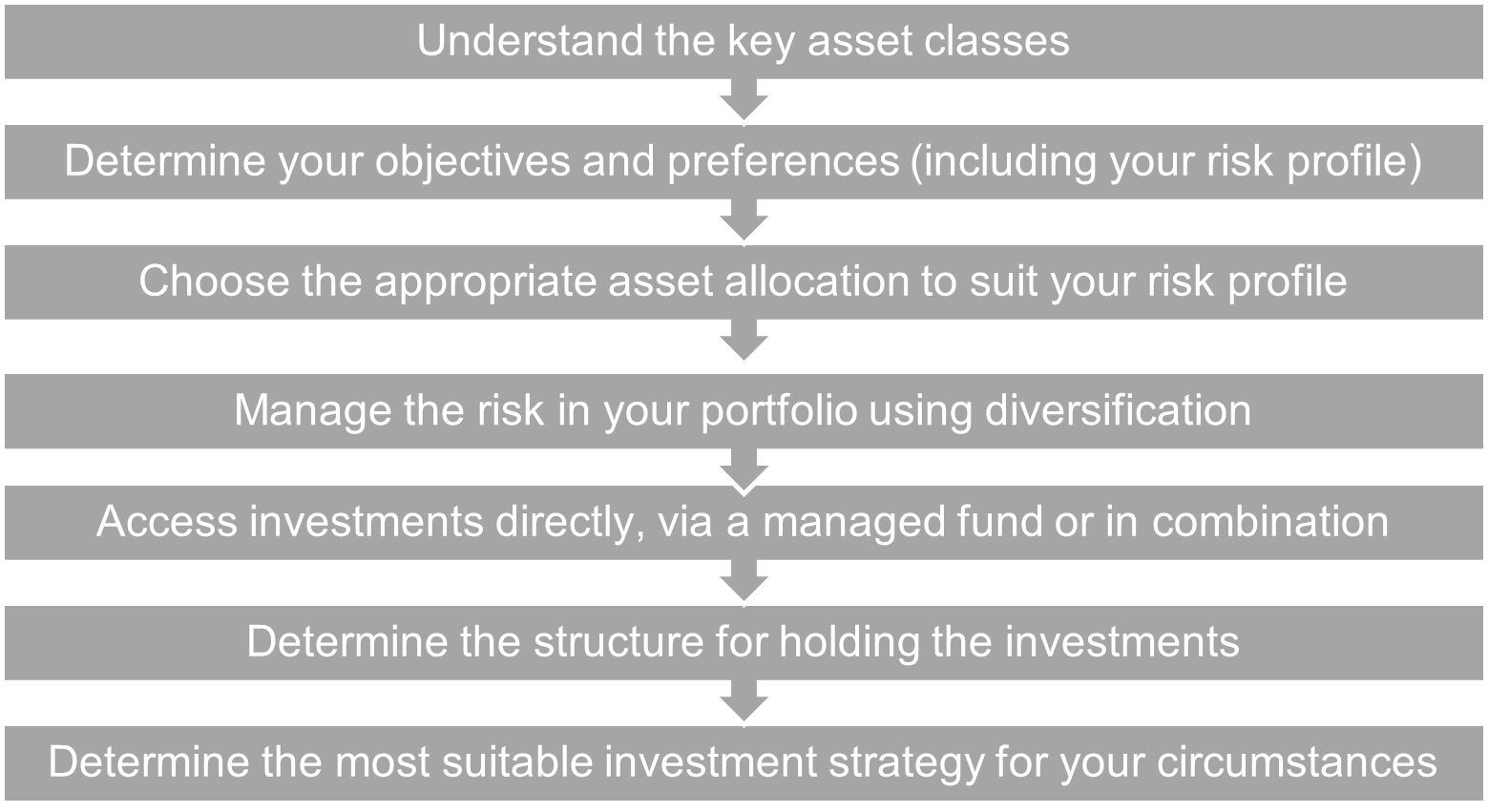

There are several steps to follow to build a portfolio that suits your financial goals and preferences. These steps are illustrated in the diagram below:

Understand the Key Asset classes

The types of asset classes include:

- Shares

- Property

- Bonds (or fixed interest as they are often called)

- Alternatives

- Cash

There are asset types within each asset class. For example, within shares, there is a choice of Australian and international shares and within international shares, there is choice of specific regions or countries like China or emerging market shares.

Generally ‘growth' assets like shares and property provide the prospect of higher returns over the long term compared to ‘safer' assets like bonds and cash. However growth assets have a higher level of risk including the risk of capital loss and more ups and downs in returns particularly over the short term. ‘Growth' assets are more appropriate if you have an investment time horizon of at least five years due to their higher level of inherent risk.

Shares: Shares represent part ownership in a company, provide income payments through dividends and produce growth if the share price increases.

For Australian companies, dividends can provide a tax credit (also called imputation credits or franking credits) for the tax paid by the company so that you are not taxed twice (once at the company tax rate and again at your marginal tax rate). If your tax rate is less than the company tax rate (currently 30%) you will receive a refund for the extra tax paid by the company.

Property: An investment in property provides you with ownership in a property or a number of properties through a managed structure. Property investments allow you to benefit from rental income received, as well as the change in the valuation of the property over time. The returns of these properties will depend on the quality of the tenant and the rent paid as well as the location and type of property (residential, industrial, or commercial).

Bonds (fixed interest): A bond is a tradeable debt security, usually issued by a government, semi-government, or corporate body to raise money. Investors in the bond have effectively lent money, for which they receive a fixed rate of interest over a set period of time. The bond is repaid with interest on the predetermined maturity date.

It is possible to experience capital losses from a bond investment if it is cashed before maturity and interest rates have risen or capital gains if the reverse occurs. They are not as safe as cash.

Alternatives: Alternative investments are supplemental strategies to traditional long-only positions in stocks, bonds, and cash. Alternative investments include investments in five main categories: hedge funds, private capital, natural resources, real estate, and infrastructure. Alternatives rely less on broad market trends and more on the strength of each specific investment; hence, adding alternatives can potentially reduce the overall risk of a portfolio. With low correlation to traditional asset classes.

Cash: Cash is one of the safest investments. Cash compared to other assets tends to provide lower variability in returns, high level of security on the capital invested and acts as a more defensive investment. This reduces investment risk, so the money is available when you need it, with a minimal potential for capital loss.

Income and Growth

The returns from the various asset classes are provided in the form of income and/or growth resulting from a change in the price of the investment. Some investments like cash will only provide income returns while the return from other investments may include a mix of income and capital growth.

This income is included in your tax return and is taxed at your marginal tax rate. If franking credits have been derived these will be passed onto you and can help to reduce tax payable.

If an investment is sold, this may create a capital gain or loss depending on whether the price changed since initially invested.

Direct versus Managed Funds

You purchase investments directly or via a managed trust.

A direct investment involves buying the security such that you become a part or full owner of the security. As an example, you can purchase shares in a specific company by buying them on the Stock Exchange.

A managed fund is a professionally managed investment portfolio that pools the money of multiple investors. A fund manager is appointed to manage the fund including selection of the investments and maintaining client records. By pooling money with other investors you may gain access to investments not normally available if you invested directly or enable you to achieve a greater level of diversification.

If you invest money into a managed fund, you will receive a number of ‘units' in that fund. The number of units you receive is calculated as the amount of money you invest divided by the unit price on that day. The unit price may increase or decrease in line with the value of the underlying investments.

Risk Profiling

Your risk profile will depend on how you feel about a range of different issues such as:

- Your comfort and knowledge of investment markets. The higher your knowledge, the more comfortable you may be investing in riskier assets like shares and property

- Your preference for capital growth (compared to capital preservation and/or income). The higher your preference for growth may be better suited to investing in riskier assets that offer a higher potential for capital growth.

- Your level of concern when markets suffer a loss. If you are likely to sell and feel stressed from this loss, then a lower exposure to risky assets may be suitable

- How important it is to you for your investments to keep pace with inflation. If this is important to you, then shares and property are more likely to meet this need

- Your investment time horizon. If you are investing for the long term (at least 5-7 years), then you may consider investing in shares and property. Generally, risky assets are not suitable if you are investing for shorter periods of time and a higher level of investment in cash and bonds may be more suitable

Structures for Holding Investments

There are various ways of owning investments and these can include in your own name, in your spouse or kids' names, via a family trust, superannuation or private company. There are several issues to consider when determining the most appropriate structure to hold the investments and these include the following:

- Tax

- Fees and costs

- Liabilities and responsibilities

- Flexibility and complexity

- Estate planning

Investment Strategies

There are various approaches to investing and withdrawing your money.

- Dollar cost averaging -this involves investing a set amount regularly over a period of time rather than investing the full amount at a single point in time. You can avoid trying to time your entry into financial markets. By making regular investments over time you may be able to minimise the risk of investing all your money during a market peak. This can help to minimise investment risk and average the purchase price of your investments by buying more assets when prices are low and fewer assets when prices are high.

You may use a combination of your own money and borrowed funds to accelerate wealth over the long-term.

- Gearing - is a higher risk strategy that magnifies both the gains and losses from your portfolio. The higher the proportion of borrowed funds compared to your equity, the greater the associated risks.

- Instalment gearing - you can combine dollar cost averaging and gearing. Instalment gearing is a margin loan facility incorporating a regular savings option. You make an initial investment using your own funds and then also borrow additional funds. Thereafter, each contribution you make matched by borrowed funds to make further investments.

- Compound interest - has the effect of increasing your overall returns. Your portfolio can benefit from ‘compounding interest' particularly if you reinvest your income returns. If the interest you receive is added to your initial investment, you can receive interest on the total amount and effectively receive interest on the interest reinvested. The more frequently that interest is calculated, the higher will be the compounded returns.

Diversification

Diversification is a key investment strategy used to manage investment risk and price volatility within a portfolio whilst still providing an appropriate level of return.

You can diversify your portfolio in different ways. Examples of diversification include investing:

- across a range of asset classes including growth assets like shares and property and defensive assets like fixed interest (bonds) and cash

- across different countries and regions such as Australian and international assets, Asia and emerging markets

- across different securities that provide you access to a range of companies and sectors.

Important information regarding this information

This information is of a general nature. It does not consider your personal objectives, needs or situation. It does not represent legal, tax or personal advice and should not be taken as such. If it has been provided to you with a Statement of Advice (SoA), you should rely on the personal advice in the SoA.

Care has been taken to provide up to date and accurate information relating to the subject area however BR Advice Pty Ltd (ABN 30 612 056 523, AFSL 488655), Blue Rock Private Wealth Pty Ltd (ABN 95 166 927 055, AFSL 452733), Blue Rock Private Wealth (Melb) Pty Ltd (ABN 48 652 202 698, ASIC AFS No. 1298365) and their representatives make no representation as to its accuracy or completeness.

Published: September 2022.

© Copyright 2022.